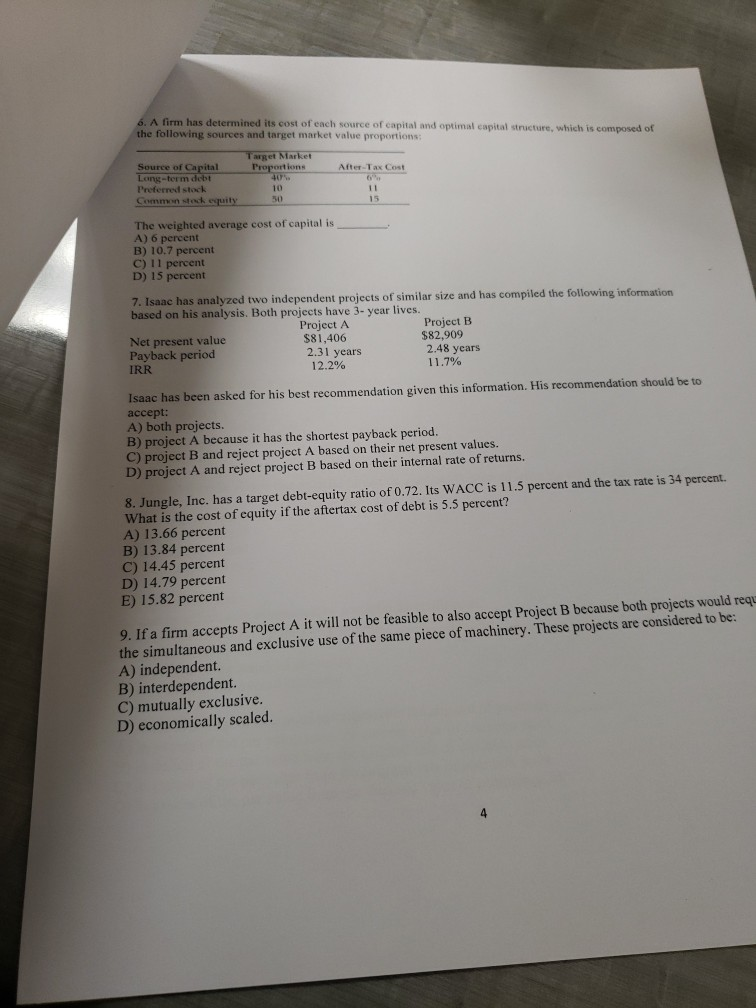

. A firm has determined its cost of each source of capital and optimal capital structure, which is composed of the following sources and target market value proportions: Target Market Source of Capital Proportions After Tax Cost Long-term debt Preferred stock 10 Common equity The weighted average cost of capital is

- A) 6 percent

- B) 10.7 percent

- C) 11 percent

- D) 15 percent

The Correct Answer and Explanation is

To calculate the Weighted Average Cost of Capital (WACC), we use the following formula: WACC=(wd⋅rd)+(wp⋅rp)+(we⋅re)\text{WACC} = (w_d \cdot r_d) + (w_p \cdot r_p) + (w_e \cdot r_e)

Where:

- wd,wp,wew_d, w_p, w_e are the weights (proportions) of debt, preferred stock, and common equity

- rd,rp,rer_d, r_p, r_e are the respective after-tax costs

From the image:

- Long-term debt: 40% weight, after-tax cost = 6%

- Preferred stock: 10% weight, after-tax cost = 11%

- Common stock equity: 50% weight, after-tax cost = 15%

Now, plug these into the WACC formula: WACC=(0.40⋅0.06)+(0.10⋅0.11)+(0.50⋅0.15)\text{WACC} = (0.40 \cdot 0.06) + (0.10 \cdot 0.11) + (0.50 \cdot 0.15) WACC=0.024+0.011+0.075=0.11 or 11%\text{WACC} = 0.024 + 0.011 + 0.075 = 0.11 \text{ or } 11\%

Final Answer:

C) 11 percent

Explanation

The Weighted Average Cost of Capital (WACC) is a critical financial metric that represents a firm’s average cost of capital from all sources, including debt, preferred stock, and equity, each weighted according to its proportion in the firm’s capital structure. It is used by firms to evaluate investment decisions, as it serves as the minimum return a company must earn on its existing asset base to satisfy its investors and creditors.

To compute WACC, each component of the capital structure is multiplied by its respective cost, and the results are summed. Importantly, the cost of debt is adjusted for taxes since interest is tax-deductible, making debt cheaper than equity or preferred stock.

In this case, the firm uses:

- 40% long-term debt with an after-tax cost of 6%

- 10% preferred stock at 11%

- 50% common equity at 15%

By applying the weights and costs, the calculated WACC is: 0.024+0.011+0.075=0.11 or 11%0.024 + 0.011 + 0.075 = 0.11 \text{ or } 11\%

This means for every dollar of capital, the firm pays an average of 11 cents in cost. A company would typically use this WACC rate as a discount rate in investment appraisals. If a project’s return exceeds the WACC, it may create value; if not, it could destroy value.

Hence, understanding and accurately calculating WACC is fundamental to sound financial management and strategic decision-making.

: