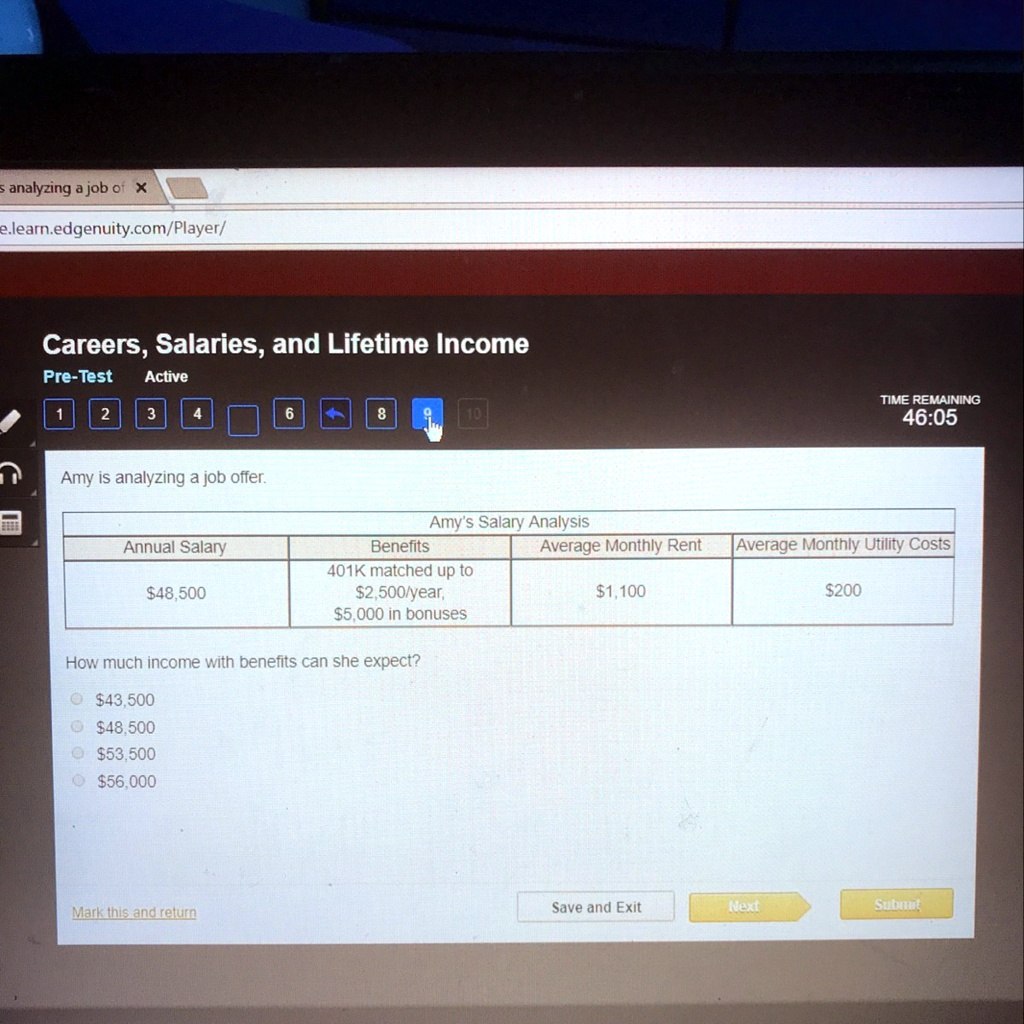

my is analyzing a job offer. Amy’s Salary Analysis Annual Salary Benefits Average Monthly Rent Average Monthly Utility Costs

1,100

2,500/year,

43,500

53,500 $56,000

The Correct Answer and Explanation is:

Income Details from the Image:

- Annual Salary: $48,500

- Benefits:

- 401(k) match: up to $2,500/year

- Bonuses: $5,000/year

Step-by-step Calculation:

- Base Salary = $48,500

- Add 401(k) Match = $2,500

- Add Bonuses = $5,000

Total Expected Income = Salary + 401(k) + Bonus

= $48,500 + $2,500 + $5,000

= $56,000

Correct Answer:

✅ $56,000

Explanation (Approximately 300 Words):

Amy is considering a job offer and needs to evaluate the total compensation, not just the base salary. This includes both her annual salary and the additional benefits the employer provides, which together form the total income she can expect.

In this case, Amy’s base salary is $48,500. However, the employer is also offering a 401(k) retirement plan contribution of up to $2,500 per year. This is an important part of compensation, even if it is not directly seen as cash—it helps build retirement savings and reduces taxable income in many cases. Additionally, the employer offers $5,000 in bonuses, which is extra money added on top of her salary for performance or other criteria.

To calculate Amy’s full income with benefits, we simply add the annual salary, the 401(k) contribution, and the bonus. That gives us a total of $56,000. This figure represents her total annual compensation, which is essential for comparing job offers or planning her budget.

Even though monthly costs like rent and utilities are provided, those relate to her expenses, not her income. The question specifically asks about expected income with benefits, so we focus only on salary, 401(k), and bonuses.

Therefore, the correct choice is: $56,000.