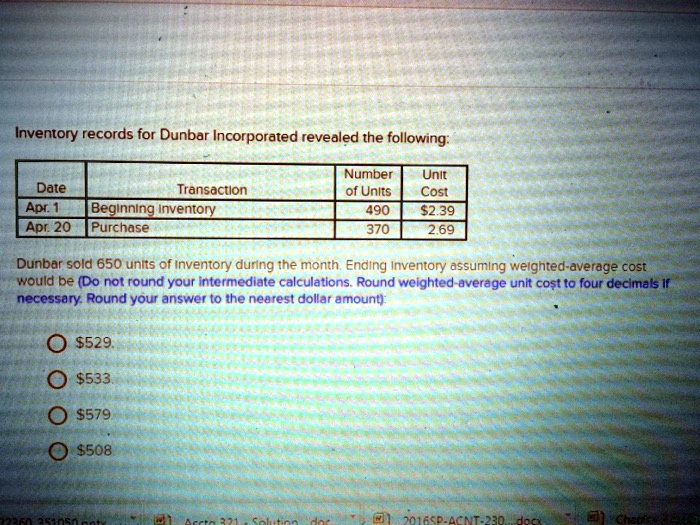

Inventory records for Dunbar Incorporated revealed the following: Date Transaction Number of Units Unit Cost Apr. 1 Beginning Inventory 490

579 $508

The Correct Answer and Explanation is:

To find the ending inventory using the weighted-average cost method, we follow these steps:

1. Calculate the Total Cost and Total Units Available

From the table:

- Beginning Inventory:

490 units @ $2.39 = $1,171.10 - Purchase on Apr. 20:

370 units @ $2.69 = $995.30 - Total Units Available for Sale = 490 + 370 = 860 units

- Total Cost = $1,171.10 + $995.30 = $2,166.40

2. Compute the Weighted-Average Cost per Unit

Weighted-Average Unit Cost=Total CostTotal Units=2166.40860≈2.5179\text{Weighted-Average Unit Cost} = \frac{\text{Total Cost}}{\text{Total Units}} = \frac{2166.40}{860} \approx 2.5179Weighted-Average Unit Cost=Total UnitsTotal Cost=8602166.40≈2.5179

3. Determine Ending Inventory

Dunbar sold 650 units, so:

- Ending Inventory Units = 860 – 650 = 210 units

Ending Inventory Value=210×2.5179≈528.759\text{Ending Inventory Value} = 210 \times 2.5179 \approx 528.759Ending Inventory Value=210×2.5179≈528.759

Rounded to the nearest dollar, the ending inventory is $529

✅ Correct Answer: $529

📘 Explanation

The weighted-average cost method smooths out price fluctuations by averaging the costs of all inventory available for sale during a period. It’s particularly useful when inventory items are indistinguishable from one another, such as in bulk merchandise.

In Dunbar Incorporated’s case, we start with a beginning inventory of 490 units at $2.39 per unit and make an additional purchase of 370 units at $2.69. This gives a total of 860 units available at a combined cost of $2,166.40.

To find a fair cost per unit that reflects both the original inventory and the new purchase, we divide the total cost by the total number of units. This gives a weighted-average unit cost of $2.5179. This cost is applied to all units equally, regardless of whether they came from the beginning inventory or the new purchase.

After selling 650 units, we are left with 210 units. We multiply these 210 units by the average cost of $2.5179 to arrive at an ending inventory value of approximately $528.76. Rounding to the nearest dollar, we get $529.

This method is widely used in financial reporting because it simplifies inventory accounting and reduces the impact of price volatility. However, it may not reflect the actual flow of goods and can distort profit figures when prices fluctuate significantly.

Thus, based on proper calculation and rounding, the correct answer is $529.