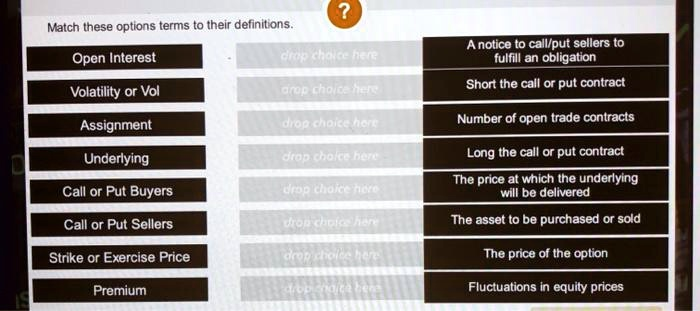

Match these options terms to their definitions. Open Interest drop choice here A notice to call/put sellers to fulfill an obligation Volatility or Vol drop choice here Short the call or put contract Assignment drop choice here Number of open trade contracts Underlying drop choice here Long the call or put contract Call or Put Buyers drop choice here The price at which the underlying will be delivered Call or Put Sellers drop choice here The asset to be purchased or sold Strike or Exercise Price drop choice here The price of the option Premium drop choice here Fluctuations in equity prices

The Correct Answer and Explanation is:

Here are the correct matches for the options trading terms:

- Open Interest → Number of open trade contracts

- Volatility or Vol → Fluctuations in equity prices

- Assignment → A notice to call or put sellers to fulfill an obligation

- Underlying → The asset to be purchased or sold

- Call or Put Buyers → Long the call or put contract

- Call or Put Sellers → Short the call or put contract

- Strike or Exercise Price → The price at which the underlying will be delivered

- Premium → The price of the option

Explanation

Options trading involves a variety of terms that define the mechanics of contracts and market activity. Open interest represents the number of active contracts that have not yet been closed or settled, indicating market liquidity. Volatility refers to the price fluctuations in the underlying asset, which influence option pricing and risk assessment. Assignment occurs when an option seller is required to fulfill their contract obligation, either delivering or purchasing the underlying asset.

The underlying refers to the financial instrument that is the basis of the option, such as stocks or commodities. Buyers of calls or puts take a long position, expecting favorable price movements, whereas sellers take a short position, profiting from premiums while assuming potential obligations. The strike price is the agreed price at which the underlying asset can be bought or sold upon exercising the option. Premium is the cost an option buyer pays to the seller for holding the contract, which factors in volatility and time value.

Understanding these terms is crucial for effective options trading. They shape strategies, risk management, and profitability, making them fundamental concepts for traders navigating derivatives markets.