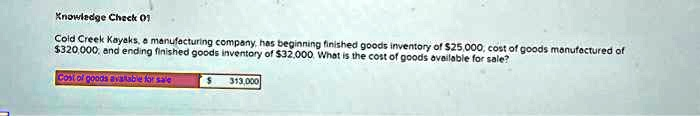

The Correct Answer and Explanation is:

Correct Answer: $345,000

The cost of goods available for sale is calculated by adding the cost of goods manufactured during a period to the beginning finished goods inventory. This figure represents the total value of all finished products that a company could have sold during that specific period.

The formula is:

Cost of Goods Available for Sale = Beginning Finished Goods Inventory + Cost of Goods Manufactured

Using the values provided in the problem for Cold Creek Kayaks:

- Beginning Finished Goods Inventory: $25,000

- Cost of Goods Manufactured: $320,000

Plugging these numbers into the formula gives the following result:

$25,000 + $320,000 = $345,000

Therefore, the cost of goods available for sale for Cold Creek Kayaks is $345,000.

The beginning inventory of $25,000 represents the value of completed kayaks carried over from the previous period. The cost of goods manufactured of $320,000 is the total production cost of all kayaks completed during the current period. By combining these two amounts, we get the total cost of all kayaks that were ready and available for customers to purchase.

It is important to note that the cost of goods available for sale is calculated before considering the ending inventory. The ending finished goods inventory of

32,000representstheproductsthatremainedunsold.Tofindthecostofgoodssold,youwouldsubtractthisendinginventoryfromthecostofgoodsavailableforsale(32,000representstheproductsthatremainedunsold.Tofindthecostofgoodssold,youwouldsubtractthisendinginventoryfromthecostofgoodsavailableforsale(345,000 – $32,000 = $313,000). The value shown in the image’s answer box, $313,000, incorrectly represents the cost of goods sold instead of the cost of goods available for sale.