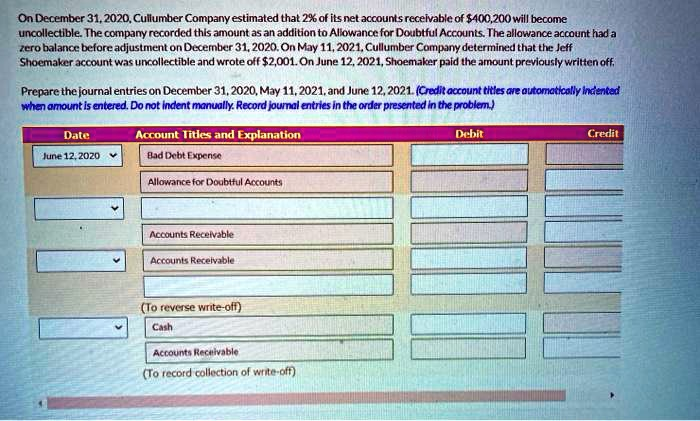

On December 31, 2020, Cullumber Company estimated that 2% of its net accounts receivable of 400,200willbecomeuncollectible.

The Correct Answer and Explanation is:

Here is the completed journal entry table.

| Date | Account Titles and Explanation | Debit | Credit |

| Dec. 31, 2020 | Bad Debt Expense | 8,004 | |

| Allowance for Doubtful Accounts | 8,004 | ||

| (To record estimated bad debts) | |||

| May 11, 2021 | Allowance for Doubtful Accounts | 2,001 | |

| Accounts Receivable | 2,001 | ||

| (To write off uncollectible account) | |||

| June 12, 2021 | Accounts Receivable | 2,001 | |

| Allowance for Doubtful Accounts | 2,001 | ||

| (To reverse write-off) | |||

| June 12, 2021 | Cash | 2,001 | |

| Accounts Receivable | 2,001 | ||

| (To record collection of write-off) |

Explanation of Journal Entries

These journal entries correctly account for the transactions related to Cullumber Company’s accounts receivable and bad debts according to standard accounting practices.

The first entry on December 31, 2020, records the estimated bad debt expense for the period. The company projected that 2% of its $400,200 accounts receivable would be uncollectible, leading to an expense of $8,004. This adjusting entry involves a debit to Bad Debt Expense, which recognizes the expense in the period of the related sale, and a credit to Allowance for Doubtful Accounts. The allowance is a contra asset account that reduces the gross amount of accounts receivable to its net realizable value.

The second entry on May 11, 2021, handles the write off of a specific customer’s account. When the $2,001 Jeff Shoemaker account was determined to be uncollectible, the company debited Allowance for Doubtful Accounts and credited Accounts Receivable. This transaction reduces both the allowance and the specific receivable. It is important to note that a write off does not impact the net realizable value of receivables or net income, as the expense was already recognized in the prior period’s adjustment.

The final two entries on June 12, 2021, address the subsequent collection of the previously written off account. This requires a two step process. First, the write off is reversed by debiting Accounts Receivable and crediting Allowance for Doubtful Accounts for $2,001. This reinstates the specific receivable on the company’s books. Second, the cash receipt is recorded with a debit to Cash and a credit to Accounts Receivable. This two part entry is necessary to maintain a complete and accurate payment history for the customer and to properly account for the cash inflow.