The Correct Answer and Explanation is:

The correct answer is $2,550.

This figure represents the company’s Cost of Goods Sold, commonly abbreviated as COGS, for the prior calendar year. The Cost of Goods Sold is a critical accounting metric that measures the direct costs associated with the goods a company sold during a specific period. For a retailer, this would be the purchase price of the items. Understanding COGS is fundamental for calculating a company’s gross profit, a key indicator of its financial health and pricing strategy effectiveness.

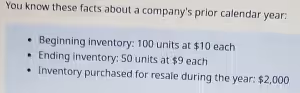

To determine the Cost of Goods Sold, we use a standard and logical formula: Beginning Inventory plus Purchases minus Ending Inventory. This calculation method follows the flow of inventory. First, we must establish the total value of all goods the company had available to sell throughout the year. This is known as the Cost of Goods Available for Sale and is found by adding the value of the inventory at the start of the period to the cost of any new inventory acquired during that same period.

Based on the provided information, the beginning inventory value was calculated as 100 units at a cost of $10 each, which totals $1,000. The company then purchased an additional $2,000 worth of inventory for resale. Therefore, the total cost of goods available for sale during the year was $3,000, the sum of the $1,000 beginning inventory and the $2,000 in purchases.

The final step in the COGS calculation is to account for the inventory that was not sold. The ending inventory consisted of 50 units valued at $9 each, for a total value of $450. By subtracting this $450 ending inventory value from the $3,000 cost of goods available for sale, we isolate the cost of the inventory that was actually sold. The specific calculation is $3,000 minus $450, which equals the final COGS of $2,550. This figure is then used on the income statement to determine gross profit by subtracting it from total revenue.